COVID19 Emergency Assistance Program Reopened at HOPE

The applications for Emergency Financial Assistance are closed. Please follow us on Facebook for updates.

The City of Evansville has allocated to HOPE of Evansville CDBG funds to provide emergency financial assistance to people within the city of Evansville. Due to high demand, application for this program will only be accepted during regular business hours (8:30-5) the 1st of each month. Only a limited number of clients will be accepted each month. To reduce wait time, there will not be a waiting list for this program.

HOPE is now accepting applications for these funds. In order to qualify you must

-

Live within Evansville City Limits.

-

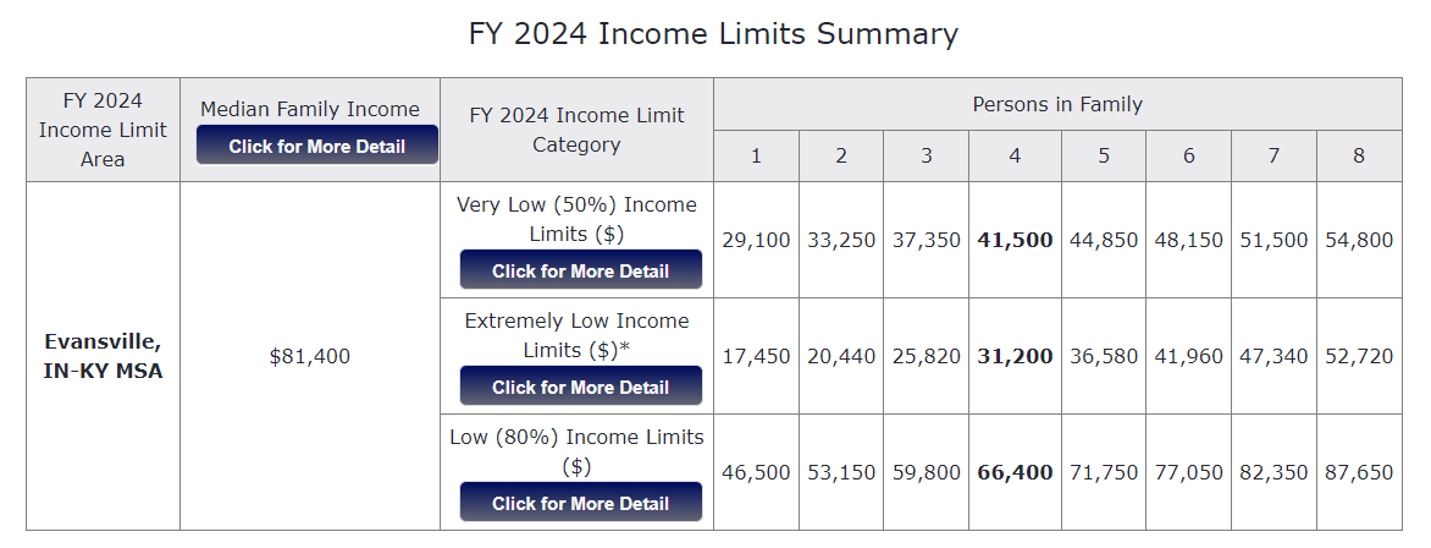

Have had an annual household income at or below 80% of Area Median Income since at least two months prior to your COVID hardship.

-

Be currently behind on a housing or utility account with you listed as an account holder.

-

Have experienced an economic hardship (loss or reduction of income) due to COVID-19.

Financial assistance is based on eligibility and need. This assistance requires documentation and can take 3-5 weeks to process after all information is received.

Approved households may have up to six months of past due rent and utilities bills brought current. Each household may only receive assistance once from this grant including CDBG COVID grant funds available through other agencies.

If you require assistance before the end of the month you apply, we recommend you contact 2-1-1 for alternative options.

Click here for a list of required documents needed in order to receive assistance.